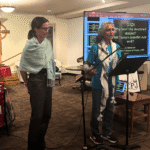

Photo by Bissan Abubaker

Ahmed Abubaker, broker owner of AA Baker Realtors, observes that Milwaukee’s housing market is threatened by a significant increase of interest rates and supply not meeting demand.

Navigating real estate in Wisconsin is more challenging than ever with the housing market’s current conditions. Interest rates and low inventory are formidable barriers that homebuyers struggle to overcome. According to Wisconsin Realtors Association data, the state saw the lowest number of home sales in eleven years last year. Then the state’s median home price reached an all-time high this year, and it has continued to steadily increase month by month.

Real estate broker Ahmed Abubaker helps homebuyers of the Greater Milwaukee area make informed decisions in the midst of such predicaments.

Originally from Palestine, Ahmed Abubaker moved to the US in 2002. His background encompasses architecture, urban planning and home design. “I’ve done many things related to the industry of the housing business,” he asserts. “When the housing market crashed in 2009, the architectural industry was one of the first to be hit by that.”

Abubaker’s experience and expertise in housing would suit him well to pursue real estate. He acquired his license in 2013 and first joined Shorewest Realtors before eventually starting his own firm, AA Baker Realtors LLC, in 2015.

Based in Franklin and currently a one-man team, Ahmed Abubaker’s firm primarily serves Milwaukee’s south side and suburbs of Franklin, Greenfield and Oak Creek. However, he has worked with clients as far north as Menomonee Falls and Fox Point or as far south as Burlington and Pleasant Prairie.

The Cap Times broke the data down a bit more; Wisconsin real estate sales are down 29% since 2021 as of this past April. Meanwhile, TMJ4 reports that home prices in Wisconsin from 2017 have risen by about 50%.

Abubaker observes that Milwaukee’s housing market is threatened by all-time high interest rates resulting from inflation. “I’ve seen customers with 8% rates, compared to interest between 2.3 and 3% during COVID times,” he explains. “That significant increase in just a few years deters lots of buyers.”

There is also the issue of supply not meeting demand. “We have more people and more companies moving into Wisconsin. That puts more pressure on the market even with the interest rate.”

Just a few years ago in the midst of the pandemic, many homes were being sold just above asking price because interest rates had been so low. “These days, because of the shortage in inventory, people are fighting over properties a lot more. One client ended up offering over twenty thousand dollars over the asking price but we did not end up even getting them the property. It forces buyers to just accept what’s available.”

High interest makes it difficult for sellers too – to the point where inventory only expands when homeowners are forced to sell their homes during foreclosure, handling estate of a deceased person or as the result of civil issues like divorce. “Most of the inventory is unfortunately coming from those situations,” Abubaker says.

Although inflation has slowed since it peaked in 2022, prices have taken time to go down. In its first decline since pandemic, the national consumer price index (CPI) fell from 3.3% in May to 3% in June, according to The Hill.

Abubaker anticipates that such a trend will reflect reduced housing interest rates in the near future, adding, “Hopefully, with some mortgage cuts later in the year, more homebuyers will be encouraged to come back to the market.”

A detailed look at the price of a modest 1,300 sq. ft. home for sale in Fox Point.

So, how does a homebuyer go about navigating all of this? Ahmed Abubaker offers advice – and a few tools.

For one, to make the process easier on the buyer, Abubaker’s firm works with banks and mortgage companies that offer incentives for first-time buyers like grants or down payment assistance. “Even the closing cost can be high, in addition to the interest and down payment,” he mentions. “It could take two percent or more just for the deal, and that worries people.”

Additionally, Abubaker organically incorporates his architectural and home design expertise into his real estate practice. He assures the utmost quality of every one of his properties and makes sure that the foundation, basement, roof and heating-cooling systems are all structurally sound.

“I’ll help my clients lay out sketches in order to finish their basement or change out their floors,” he details. “I can also put my clients in touch with good contractors, plus I still do some house remodeling on the side to keep myself busy.”

Abubaker encourages buying sooner than later. In fact, he recommends buyers not to wait for their “dream” house. If a house has 70 to 80% of their requirements, a buyer should jump on it; otherwise, they might get stuck fighting over houses with other buyers.

“Even if someone buys a house while the price is high, at least the asking price now is not as high as it was during peak COVID,” he elaborates. “Then once the interest rates go down, they’ll have a better opportunity to refinance existing loans on their houses.”

Abubaker remains patient with his clients and is exceptionally malleable to his clients’ needs. In fact, he acquired his mortgage license just so he could help guide clients through that process rather than leave them stuck dealing with unhelpful mortgage lenders over the phone.

Abubaker has noticed more Muslim homebuyers moving to Milwaukee in recent years, especially from Minnesota and Illinois. A Muslim himself, he believes that the biggest factor for this influx is education – specifically Salam School. “It is definitely the focal point attracting people since it is the biggest Islamic high school in the country, and it has a very highly rated program and graduation rate.”

Another factor is likely the aforementioned economic growth occurring in Wisconsin as more companies and businesses are opening branches, facilities and professional sectors here. “Anybody looking for a job will have many options to pick from these days, we have built up a great community where people can really find what suits them.”

A positive change for homebuyers, starting next month, sellers no longer have to pay both their agent and the buyer’s agent upon selling a home, as NPR reports.

AA Baker Realtors LLC is located at 4015 W Jerelin Drive in Franklin and Ahmed Abubaker can be reached at 414-921-0255.