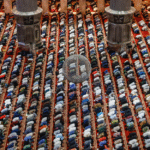

(The Conversation) — The growth of “halal mortgages” over the past 20 years has expanded financial access to homeownership for many Muslims. Halal mortgages provide interest-free loans in keeping with Islamic beliefs.

These mortgages are available in over 80 countries that have a significant Muslim population, such as Saudi Arabia, Iran, Malaysia, United Arab Emirates, Kuwait, Qatar, Turkey, Bahrain, Indonesia and Pakistan, where they account for the vast majority of the global US$3.9 trillion Islamic finance economy.

Access to halal mortgages has been growing in the United States. Until 1997, no financial institution was willing to offer halal mortgages, but in 2024, over 25 banks had made them available.

The Conversation asked Shariq Siddiqui, assistant professor and director of the Muslim Philanthropy Initiative at Indiana University, to explain halal mortgages.

What are halal mortgages?

Halal mortgages are a tool of Islamic finance and offer an equitable way to gain homeownership. They emphasize risk-sharing and mutual cooperation with the aim of checking unfair exploitation and wealth accumulation in the hands of a few. In such a system, money is a means of exchange rather than a commodity that generates profit.

What are the religious roots of Islamic finance?

The Muslim holy book, the Quran, and the sayings of the Prophet Muhammad, the Sunnah, prohibit riba, (interest), maisir (speculation) and gharar (uncertainty or uneven risk).

For example, the Quran says, “O you who believe, do not eat up the amounts acquired through ribā (interest), doubled and multiplied. Fear Allah, so that you may be successful.”

Over time, Muslims have sought to develop systems that adhere to these rules. These include bonds that do not receive interest but are based on profit-sharing; socially responsible mutual funds that comply with ethical rules; and insurance that provide protection through a communal fund.

Since World War II, however, monetary policies in the global financial market are largely based upon interest.

How does Islamic financing work in modern context?

In the modern context, Muslims use contract law for economic activity and offer home mortgages without interest. For example, as an attorney, I would develop mortgage contracts that would allow buyers and sellers to transact without interest. This “mortgage” contract would be recorded with the county.

Traditionally, there are three kinds of halal mortgages. In the first, known as ijara, the bank purchases the property and leases it to the homeowner; the homeowner pays rent, principal payments and bank charges; the buyer’s share in the home remains the same until the entire loan is paid off.

Diminishing musharaka is another type of joint ownership plan between the bank and the buyer. The buyer makes principal monthly payments and pays bank charges rather than interest. With each principal payment, the ownership of the buyer increases and the bank’s ownership decreases.

In the third type, murabaha, the bank purchases the home and resells it immediately to the buyer at a higher price – termed as profit. The buyer typically pays a 20% down payment. Thereafter, the buyer makes fixed interest-free payments until the loan is paid off.

What is the availability of halal mortgages in the US?

In 2001 and 2003, respectively, Freddie Mac

and Fannie Mae started buying Islamic mortgage products to provide extra liquidity in the U.S. Islamic finance market. These government-backed housing giants work under the conservatorship of the Federal Housing Finance Agency and are one of the principal means of bolstering homeownership in the United States.

These mortgage buyers have grown to become the main investors in Islamic mortgages. For example, Freddie Mac has invested in Guidance Residential, one of the largest halal mortgage companies in the U.S.

What are the advantages?

These systems ensure that there is mutual risk-taking between the bank and the homebuyer. For example, should the homebuyer be unable to keep up payments, their prior principal payments are protected and not consumed by the interest. Furthermore, if the home loses value, both homebuyer and bank proportionally lose out on the principal value of the home.

They require greater transparency on costs, fees and responsibilities; both parties are required to work together and fulfill their obligations.

This reduces the risk of failures like the subprime lending crisis, when banks overvalued homes and financed mortgages that buyers could not afford, leading to a global recession in 2008.

What are the downsides?

Halal mortgages are more expensive and more difficult to enter into, as they require a down payment of at least 20%. Furthermore, they are not available in every state in the United States.

Additionally, many Muslims are unwilling to deposit their money in banks, if those banks are required to pay interest or earn part of their revenue based upon interest.

(Shariq Siddiqui, Assistant Professor & Director of the Muslim Philanthropy Initiative, Indiana University. The views expressed in this commentary do not necessarily reflect those of Religion News Service.)