Photos Courtesy of:

Islamic Society of Milwaukee – West

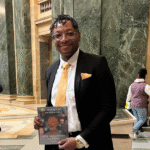

Shaykh Joe Bradford spoke on family finance at Masjid Al Noor in Brookfield.

When Muslims ask about shariah law and family finances, they usually want to know what is allowed, “what’s halal and what’s haram,” said Shaykh Joe Bradford, an expert on issues involving Muslims and finance in North America. “Maybe they want to buy a house or a car and they want to know how they can finance it. What model of financing should they use?

“I am here to talk with you about something more meta, what is going on underneath,” said the entrepreneur and American scholar of Islam in a talk about Islamic family finance at the Islamic Society of Milwaukee – West earlier this month. “There are questions we have to answer before we go get a one-off answer from the shaykh. We worry so much about the mortgage but we don’t worry about the things that will get us to afford that mortgage.”

About 50 people attended Bradford’s Oct. 1 talk on family finance. From the perspective of one who has studied traditional Islamic law and the requirements of the United States’ legal system, Bradford spoke about creating a sound financial life from the moment you establish a family to planning for the financial future of your family after you die.

“Many times we don’t have the conversations necessary to secure our families’ finances for now and in the future. The Number One thing we can do now, today, to make a difference in our lives and the lives of our families is to include our families in our financial decisions,” he said.

Joe Bradford is one of the few experts on issues involving Muslims and finance in North America.

Bradford’s path to understanding the intersection of shariah and U.S. financial law

Bradford is knowledgeable about both shariah law and U.S. financial law. He holds a master’s degree in Islamic law from the University of Medina in Saudi Arabia. He was a vice president and senior shariah consultant for Al-Rajhi Bank, the largest Islamic Bank in the Middle East.

After returning to the U.S., he co-founded MyWassiyah.com, where he provides consultation on Islamic inheritance that meets the requirements of the U.S. legal system. He is the shariah advisor to Zoya.Finance and has created an app that helps clients build and monitor a shariah-compliant investment portfolio.

He is also the principal of Moneycoa.ch, where he consults businesses and individuals who want to align their business and personal finances to their values as Muslims.

His journey on this professional path began at a young age. He has been entrepreneurial as far back as he can remember, he said. As a young teenager, he sold candy bars from his backpack.

At 15 years old, he showed up on a Sunday at the Islamic Center of North East Florida, a year after Hafiz Muhammad Shafiq (now the imam of Masjid Al Qur’an in Milwaukee) became imam.

“He was my very first teacher, my very first mentor. He was very patient with me al hamdullah in my rebellious and somewhat—I was a teenager in Florida; let’s put it that way. I accepted Islam in Jacksonville, Florida.”

Bradford went on to study at the University of Medina, where he completed his bachelor’s degree. He was the first American admitted to the university’s master’s degree program in Islamic law.

He remembers the night he made the decision “to specialize in Islamic finance generally, and Muslims and money specifically,” he said. It was the late 90s or early 2000s and Bradford was attending a lecture in Houston by a famous Islamic scholar who answered a list of financial questions from the community.

“As he answered the questions, every question was answered as ‘haram, haram, haram, la, la bijooz, not allowed. No, probably haram.’

“There was a brother who was extremely frustrated. ‘Haram, haram, haram. Ma fee halal? Everything is haram! Where is the halal?

“His frustration resonated with me,” Bradford said. In the first verse in the Quran, it says “In the name of God, the most merciful.” Where is the mercy if everything is haram?’

“From there I started on my journey of specializing in this area,” he said.

About 50 people attended Joe Bradford’s talk on Muslim family finance.

Talk about it!

The heart of Bradford’s advice to his audience in Brookfield was to go beyond applying the labels of “allowed” and “forbidden.” Instead, talk honestly, openly and transparently within your family about financial issues. Involve all your family in your financial decisions.

“We have to stop acting unilaterally and start taking the advice of people in our families, both men and women, both young and old, to understand what would be best for our families,” Bradford said.

“We have a very affluent community al hamdullah. As a community, we are very debt-averse and we have a very high rate of education for men and women. We have high earning rates for both men and women.

“But many times, we don’t do the most important thing with our families. Although we earn a lot and we are very generous, the one thing we don’t do is discuss with our families what it means to be wealthy. Having wealth is not having lots of things; it is having wealth of the heart, wealth of the soul.”

Talking with our children

Discussing financial matters with children from an early age can inculcate values, Bradford said. “If we work hard to earn a lot and we leave a lot to our children but they don’t know why we worked that hard or what our goals were in life are, they will grow up with a sense of entitlement. They will grow up with expectations that this is just how it should be.”

Talking about money creates an opportunity to talk about values, Bradford said. “Why do you work hard? You have to explain, ‘Baba is going to work so we can have money to do something nice on the weekend. I’m not going because I don’t want to be with you. I’m going because this is how we pay bills.”

Bradford took the opportunity to teach his youngest children about budgeting. He gave them the bill receipts for a month and asked them to add them up. Then he showed them a paycheck and told them to subtract the bills from the amount on the paycheck.

“It starts your children’s minds to churn as they start understanding 1) the value you bring to the family 2) the level of attention to detail it takes to manage money and 3) that life is not free. You are showing them you are working hard to provide a better future for them.”

You have to be honest with your children, he cautioned. “Don’t hide your financial mistakes. If you spent too much money, if you went into debt and you got out of it, or if you went into debt and you are working to get out of it, share that with them. Children appreciate honesty.

Talking with your spouse

“You know who else appreciates honesty even more? Your spouse. It is a form of “financial abuse” and, yes, it is an actual industry term. If you hide the facts and don’t have the types of conversations necessary so you as a family unit can be successful, you can be putting this other person in extreme harm and detriment for a very long time. This is “financial infidelity,” he said. “I can tell you everybody is guilty – both men and women. The solution is to be open, honest and transparent.

“Set family goals and learn together. If you want to take a family vacation, if you want to buy something for your home, not only have conversations about it. Set goals and allow them to work towards the goals with you.

“All of us know the famous hadith that says, ‘Actions are by intention. But there are also specific intentions we make about our money. While you save, while you forecast, while you invest, you still must have a charitable component of giving back.”

Planning starts with tracking one’s spending and forecasting, Bradford said. “It is very important for us to understand how much money we make and how much we spend. I work with couples about budgeting and financial planning and I can tell you that unfortunately, there is a high number of people in our community who hide money from each other.

“Your responsibility to yourself and your family should never stop you from giving. But everything has to be measured and balanced. Otherwise, you get to the point where the husband goes to the masjid and commits $20,000 to a fundraiser, and he is hoping his wife is not watching the live stream and his friends don’t tell her about it.

“You have credit card debt in families where everybody has their own credit card and everybody is spending and spending and spending. There are people who will run up $80,000, $90,000 and $100,000 in credit card debt and hide it from their spouse. This is both men and women and this happens frequently.”

Another concern for families is how they gain their money. “The Prophet was asked which earning are most wholesome? He said, ‘A man doing work with his own two hands and every blessed sale. What is a blessed sale? One in which you were honest. You were opened and transparent, and you dealt fairly and equitably with everyone.

“It’s not just about manual labor. It’s anything where you apply yourself to be able to seek the blessings of Allah.”

Planning for your family’s financial future

For young adults, Bradford advises them to create a plan to save and start now. “You’ll be amazed at how much you can save by putting away $20 every week or even every month to be able to invest in something that is allowed that is halal.

“If you are not married, have frank conversations with the person you intend to marry so you can have a firm foundation as a family. And have full disclosure about what your values are about money and how you expect to spend it.

“Having debt, using credit, is not necessarily a bad thing. It is the irresponsible management and the intention not to pay back that debt that is bad.”

Planning ahead for retirement, for our children’s education and their marriages is an honorable thing, Bradford added. Also planning for the care of our parents as they age is important.

“I have never consulted for a single Muslim couple who has not allocated for the care of their elderly parents. Mashallah, I think we have a very, very beautiful thing in our community where we take care of our elders. This is a huge blessing.

“Am I doing right by my family? Am I doing right by the money I am entrusted with? That is what is important,” he said.

Planning for the Day of Judgment

“The two feet of the believer will not move on the Day of Judgment until he is asked about four things, Bradford explained. “He is asked about his life and how he spent it; he is asked about his knowledge and what he did with it; he is asked about his body and how he used it; and he is asked about his wealth, where he earned it and how spent it.

“It’s not just about being charitable when you are making haram wealth. It’s not just about making halal wealth when you are not spending it on your family and when you are not being charitable.”

Having life goals does not mean we are living for the dunia, the world, he explained. “People ask me why I’m encouraging people to chase after worldly things. I’m not encouraging them to chase after the dunia. I’m encouraging them to manage what Allah is giving them.

“The Prophet is reported to have said, “I would not like to sleep for two nights except if I had given it all in Allah’s path, except for a dinar I saved to pay off my debts. Notice the prophet was planning, forecasting, budgeting. He was saving and he had the intention to pay back the people he owed. So, we are asking ourselves, can we be responsible with our money?”

Bradford’s lecture addressed many specifics about prenuptial agreements, estate planning, inheritance, having wealth and other important financial matters.