Palestinian farmers pick olives during harvest season at a grove in Khan Yunis in the southern Gaza Strip. (AFP)

DUBAI: The latest victim of planetwide shifts in temperatures and weather patterns appears to be the ancient olive tree.

A yearlong drought coupled with a blistering summer in southern Europe, the heartland of olive oil production, has left Spain, the world’s largest producer, and other countries struggling to satisfy global demand for the kitchen staple.

As a result, manufacturers across Europe have turned their attention to the Middle East for help in overcoming the shortage.

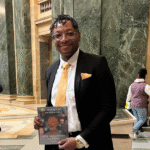

“The supply gap needs to be filled and there’s no better time for the Middle East, and particularly the Gulf states, to begin filling this gap,” said Mazen Assaf, an olive oil sommelier and entrepreneur.

The Arab world is regarded as the birthplace of olive oil and is home to about 1,600 varieties of olives, says Mazen Assaf, an olive oil sommelier and entrepreneur.

“The opportunity is there and clearer than ever.”

In recent months, Italy and Portugal, the world’s second- and fourth-largest olive oil producers respectively, have also encountered climate-related setbacks, leading to diminished stocks.

In contrast, Greece, which is third largest producer, has benefited from mild weather and adequate rainfall throughout the year. Even so, it is struggling to meet the surging international demand for the commodity.

“Olive oil is a culinary staple that is deeply ingrained in Mediterranean culture. However, its influence spans the world,” Assaf told Arab News.

“Demand for it is growing globally and supply is dropping dramatically across Europe, which is leading to higher prices around the world.”

Typically, Spain produces more than 50 percent of the world’s olive oil, with an average of 1.2 million tons per year.

But for the past two years, a series of heatwaves marked by temperatures pushing 40 degrees Celsius have whittled the country’s output down to about 600,000 tons.

The Chetoui and Chemlali varieties are popular in Morocco and Tunisia, and the Souriani, which is native to the Levant countries. (AFP)

As a result, the price of a bottle of olive oil in Spain rose by about 60 percent in 2022 and currently hovers around 10 euros per liter at retail for the extra virgin type.

The reverberations of Spain’s drought and olive oil shortage are being felt in Turkiye, where the trade ministry has imposed a three-month ban on olive oil exports.

“Spain’s worries are not exclusive to it,” Assaf said, adding that wildfires were becoming an increasingly common phenomenon across the Mediterranean.

“The presence of the xylella fasticiosa bacteria in these lands is also slowly killing olive trees, leading to a further drop in supply,” he said, referring to Greece and Italy.

According to some reports, the deadly bacteria has killed more than 21 million olive trees in the southern Puglia region of Italy, which until recently accounted for half of the country’s olive oil production.

Naim Ben Said, a partner at the Dear Goodness mill in Tunisia, said global olive oil production had fallen 20 percent from the previous harvest season, primarily as a result of reduced output in Europe.

TYPES OF OLIVE OIL

• VIRGIN: This is the pure juice extracted from olives through mechanical means. Depending on specific quality parameters like acidity and oxidation, it can also be classified as extra virgin.

• MIXED: Also known as pure or ordinary olive oil, this is a blend of extra virgin and, typically, chemically refined oil.

• POMACE: This is extracted from the residue of olives after the initial pressing process.

Source: Naim Ben Said, partner at the Dear Goodness mill in Tunisia

“In terms of global consumption, the EU, US and Turkey account for more than 65 percent of the total,” he told Arab News.

In terms of per capita consumption, Greece ranks top with an annual average of 12.7 liters, followed by Spain with 11.6 and Italy with 9.1.

By comparison, in the Middle East and North Africa region, Morocco has the highest per capita annual average consumption with four liters, followed by Syria with 3.9 and Tunisia with 2.5, according to Said.

With the current production levels predicted to become the new normal, several countries in the Middle East, notably Lebanon, Tunisia, Morocco and Jordan, are helping to cover the shortfall.

An aerial view of an orchard of olive and fig trees in the village of Kurin in the rebel-held southern part of Syria’s northwestern Idlib province. (AFP)

According to Assaf, the Arab world is regarded as the birthplace of olive oil and is home to about 1,600 varieties of olives, including the Chetoui and Chemlali that are popular in Morocco and Tunisia, and the Souriani, which is native to the Levant countries and known for its exquisite flavor and high levels of antioxidants.

“Lebanon has seen a surge in exports, while Tunisia and Morocco have historically exported over 90 percent of their production to Europe, where it is bottled and filled as European oil,” he said.

Despite being in the grip of a severe and prolonged economic crisis, and the related challenges of labor shortages, power disruptions and soaring inflation, Lebanon produced 17,000 tons of olive oil in 2022-23, in keeping with its five-year average.

Facilities in Saudi Arabia and Jordan have also ramped up their production capacity.

The latter has maintained a steady supply of olive oil despite the setbacks dealt by climate change and water scarcity. Production is predicted to increase by up to 25 percent during the next season, with a slight rise in prices, according to the Jordanian Olive Presses Owners’ Syndicate.

In recent years, Jordan’s olive oil production has experienced fluctuations, including a decline from 34,720 tons in 2019 to 23,000 tons in 2021. But the outlook is bright.

The olive oil industry plays a crucial role in countries across the MENA region, providing a livelihood for farmers and supporting domestic and international trade. (AFP)

According to its agriculture ministry, Jordan is home to about 11 million olive trees, accounting for 72 per cent of its fruit tree cover and nearly 30 per cent of its cultivated area.

The likelihood of global temperatures surpassing the critical 1.5 degree increase threshold by 2027 poses a significant threat to the olive oil harvest cycle in many Arab countries, including Jordan.

“The impact of this is pushing the world into uncharted territory, where similar climatic scenarios to those playing out in Europe cannot be ruled out for countries in the Middle East and North Africa,” said Farah Najem, a senior consultant at engineering and professional services firm WSP.

She said that the current olive oil crisis presented a unique situation for economies in MENA, many of which had a traditional reliance on primary industries such as olive harvesting.

“From the Greeks to the Romans, to multiple geographies across MENA, olives have found their way into the bowls and plates of civilization for centuries,” she told Arab News.

The olive oil industry plays a crucial role in countries across the MENA region, providing a livelihood for farmers and supporting domestic and international trade.

Despite the challenges facing the industry there is still reason for optimism, with innovative and sustainable strategies helping to ensure its future, according to Najem.

According to Fortune Business, the size of the global olive oil market currently stands at $14.20 billion. (AFP)

“Many initiatives for increased food production in the region demonstrate the resolve to overcome geographical limitations, water scarcity and climatic difficulties,” she said.

Such initiatives showed how sustainable production could be a key factor in preserving food security and economic stability, she said.

“The upshot for countries in the Middle East with active food and water security initiatives is that they can position themselves to create robust domestic food security mechanisms while enhancing economic stability against global market fluctuations,” Najem said.

According to Fortune Business, the size of the global olive oil market currently stands at $14.20 billion, and it is expected to grow to $18.42 billion in 2030 — that is, at a compound annual growth rate (CAGR) of 3.3 percent. In the Middle East and Africa (MEA) region specifically, the market size is expected to grow at a CAGR of 2.18 percent over the same period.

“This represents a significant growth projection for MENA, a region that is home to several countries leading the charge to be at the forefront of the global food security agenda,” Najem said.

Meanwhile, non-Mediterranean countries have also been witnessing a steady increase in demand for olive oil.

“Olive oil is the healthiest of fats, it is packed with antioxidants and is a core ingredient of the healthy Mediterranean diet,” Assaf said.

“With it being naturally vegan, it is becoming ever more attractive to the average consumer.”

“Olive oil is the healthiest of fats, it is packed with antioxidants and is a core ingredient of the healthy Mediterranean diet,” Mazen Assaf said.

He said there had been a surge in demand for olive oil in the US — along with a sharp increase in production, especially in California — as well as in Southeast and East Asia, where countries like Japan had shown a keen interest in olive oil production as consumption soared.

Chile, Australia, Argentina and Brazil are also known to be increasing production, which points to a bright future for the olive oil industry, which is of considerable economic, cultural and agricultural value around the world.

Assaf said: “I am sure that this industry is not one we will let go of lightly. Olive oil is our culture, our heritage, our passion, our lifeline and our love.”