Photos by Kamal Moon

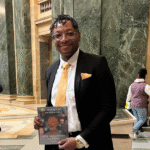

Jamal Amro owns and operates Dura Services, 6001 S. 27th St., Greenfield, a respected full-service, tax, accounting and business services company.

You might think Dura Services, , 6001 S. 27th St., Greenfield, a Muslim-owned and well-respected full-service, tax, accounting and business services company, is stressed right now since tax season and Ramadan overlap this year.

You’d be wrong!

The nation’s 2024 tax season officially started Jan. 29, when the U.S. Internal Revenue Service began accepting and processing 2023 tax returns. And business at accounting firms only accelerates as the April 15 deadline approaches.

The holy month of Ramadan began at sunset March 10. During Ramadan, Muslims worldwide observe a stringent fast from food and drink, even from drinking water, from pre-dawn to sunset, commemorating the month in which God revealed the Qur’an to the Prophet Muhammad.

The fast continues this year through about April 9, with Eid al-Fitr, the celebration of the completion of the fast, observed the following day. (The start and end of Ramadan are contingent on the sighting of the crescent moon, as Ramadan is a month in Muslims’ lunar calendar. Ramadan begins 10 or 11 days earlier each year, moving around the Gregorian calendar, which has been used in much of the world since it was adopted in 1582 by Pope Gregory XIII.)

“Ramadan is always a little tough the first couple of days,” as their bodies adjusted to fasting, Dura Services’ president and CEO Jamal Amro admitted. But once into the fasting routine, it’s pretty much business as usual, he said.

Amro, a Palestinian American, and his family members who work in the business, his wife Amal, son Albara and Albara’s fiancé Mariam Sarsour, are observant Muslims. With Ramadan and tax season overlapping, they are very busy but not stressed, he said. The company makes time for its employees to keep their duties as Muslims the priority, he said.

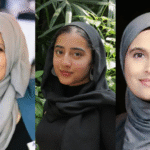

Jamal Amro and his team at Dura Services in Greenfield are in the midst of a busy tax season and Ramadan, when Muslims fast from all food and drink from pre-dawn to sunset.

What it means to be a Muslim business owner

What does it mean to be a practicing Muslim with a thriving business?

They go hand in hand, Amro said. “When people are looking for someone to trust with their finances, they are looking for honest individuals. When people started discovering us, our business took off.”

Clients quickly learned that Dura Services could be trusted to keep their business information confidential. “They started discovering this is what we do. No piece of information, and I mean nothing, leaves the office. Your information, everything about you, cannot be touched. That’s important to people. So, our business grew by word of mouth.”

Immigration specialist Amal Amro heads the company’s immigration services.

In addition, Dura Services accommodates for staff members’ duties as Muslims year-round. Among the five pillars of Islam are the requirements to pray five times a day and to fast during Ramadan. Amro makes sure Dura’s team has time to fulfill their duties, without sacrificing the quality of work or their own income, he said.

Dura Services is usually open from 9 a.m. to 5 p.m. during the week and is closed on Saturdays and Sundays. During tax season when it doesn’t overlap with Ramadan, the firm has extended hours, from 9 a.m. to 7 p.m. and is open on Saturdays from 10 a.m. to 5 p.m.

This year, while observing Ramadan during tax season, their hours are 9 a.m. to 6 p.m., because iftar, the breaking of the fast at sunset, falls around 7 p.m. this year, Amro explained. After 6 p.m., no one is in the building. They also open on Saturdays from 10 a.m. to 5 p.m.

Every Friday, all year long, the office is closed from 12:30 p.m. to 2 p.m. for Jum’ah prayer, when Muslims gather at the mosque to pray. No one is obliged by the company to go to the congregational prayer but they are free during that time and it is paid time, Amro explained. “We just don’t open to the public during those hours.

“It was the same policy when I had Garden of Eden,” he said about a grocery store he previously owned on Mitchell Street on Milwaukee’s southside. I would close during the prayer hours, even though most of my employees then were not Muslims.”

Tax preparer Muhammad Musa is especially busy during this time of the year.

An entrepreneur in the Garden of Eden

Amro’s first business was a grocery store on Milwaukee’s southside named Garden of Eden, which he opened in 1997.

“I was into numbers,” he recalled. In 2000, he started helping store customers with tax returns. “First a few friends would come in. That’s how it started.”

He decided to pursue a master’s degree in business administration (MBA) at Cardinal Stritch University in 2001, building on higher education that began in Germany. He completed it in 2002.

“I was always eager to come to the United States because of all the things I heard about it. I would correspond with U.S. universities but never got the chance,” Amro said. He was admitted to a college in Germany but still hoped to go to the U.S.

Then a friend of his married an American he met in Stuttgart. After she finished her Ph.D. in Germany, they moved to the U.S. in 1981. “I sent my application to the University of Wisconsin-Madison with them and was admitted. It was amazing. I never expected it,” he said. He transferred to UW-Whitewater, where he earned a bachelor’s degree in business in 1988. Then he got a clerical job with a shipping company and later worked in sales as a custom broker for an international company.

After a few years in corporate America, he started a grocery store he named “Garden of Eden.” Being self-employed is where it’s at, he said. “Now I tell my clients, this country is for the self-employed. There is a lot of tax-sheltering for the self-employed. You keep more of your hard-earned money. When you are an employee, you’re taxed on every penny you make.”

In the basement of Garden of Eden, “I got busy with tax preparation and accounting.”

Around the same time, Amro’s brother Imad lost his job at Arthur Anderson when the company “took a nose dive with the Enron case,” he said.

“I said, ‘You know what? I know a lot of people. So, if you open an office for taxes and bookkeeping, I’ll send you some clients,’” Amro recalled. Imad opened an office on 6th and Mitchell.

“After eight months, he called me and said, ‘I have the corporate mentality. I cannot deal with this. I’m going to give it back to you or I’ve got to close it.’” In 2002, after tax season, Amro took over.

“I had some people interested in buying Garden of Eden so I sold it in August. That worked out.”

Amro moved into the office at 6th and Mitchell and Dura Services launched in August 2002.

Growing through service

Amro found his niche. “I like to deal with people and be a tool in educating people,” he said. “I felt I can provide a service through the teaching process—teaching people in our community about taxation. And it felt good helping people out.

“This is what I love about the job, aside from working with numbers—you work with all kinds of people, helping them find legal ways to keep more of their earnings, maximizing what belongs to them. Nobody should pay more than they are supposed to.”

Finding solutions for clients “gives me gratification,” he said.

Reflecting on his 23 years as the owner of Dura Services, Amro remembers the first three years as difficult. “It was hand to mouth,” he said. “Then people heard about us and started coming in.”

His clients include businesses, nonprofits, and individuals. Gradually, Dura Services’ range of services expanded beyond tax preparation to meet clients’ other needs including payroll services, bookkeeping, business consulting, translation and immigration services.

Dura Services moved to its current location, 6001 S. 27th St., Greenfield, in 2011.

“Our initial goal was to help the Arab American community understand the concept of taxation because we don’t have it back home. But we had clients of a lot of other immigrant ethnicities from across the spectrum.”

Dura Services moved to its current location in 2011. “After we moved, we started seeing increases in our white American clientele base.” Word of mouth about Dura Services’ professionalism and ability to save money for its clients accounts for its growth, Amro said.

Today, in Dura Services’ 23rd year, he has 10 employees and a wide range of clients, businesses and individuals. And tax preparation is no longer its bread and butter. “Today it’s doing payroll and sales tax for companies,” Amro said. “That’s how we operate through the year. We also do a lot of business consultation.”

Dura Services’ team includes (left to right): President/CEO Jamal Amro, immigration specialist Amal Amro, Vice President Albara Amro, payroll processor Mariam Sarsour, administrative assistant Renad Okour, payroll administrator Saba Quli and administrative assistant Nayrouse Al Saffarini. (Not shown, tax preparer Muhammad Musa.)

Moving on?

Amro’s son Albara has been helping with the business since he was 17 years old, Amro said. Today he is the company’s vice president. Albara earned a bachelor’s degree in accounting from UW-Parkside.

“His younger brother Adam helps sometimes, too,” Amro added.

Amal Amro works exclusively with immigration and handles all of Dura Services’ immigration work. She studied at a two-year college in Jordan before moving to Milwaukee and going to Milwaukee Area Technical College. She started at Dura Services in billing.

“She is very thorough and very organized,” Amro said. “She knows what she is looking for.”

Amro, 64, hopes to gradually shift the responsibility of the business to his son Albara, 22, but said he will always “keep his hand in it.”

“In the beginning, it was difficult for him to accept taking over the business. He wanted to do his own thing,” Amro said. “I never forced him. I told him, this business is established but it’s your decision whether to be a part of it or not.” They’ve continued to work together and Amro hopes to transfer the business to Albara one day.

He admires his son’s ability to get things done while working 9 – 5, he said. “This generation is not like us, working all the time. But the productivity is still there.”

Amro has cut back on his own work hours. After tax season, he will work from 10 a.m. to 3 p.m., four days a week.

“I don’t see myself retiring 100%,” he added. “To sit at home and call myself ‘retired,’ I don’t see that. You know, this is my baby.”

Dura Services founder and owner Jamal Amro (right) plans to pass his company on to his son Albara (left) one day.

Passing on what he’s learned

Amro said he is thankful for the “amazing support from our community. I have been blessed to have the opportunity to be here for them to advise and guide them.”

His advice to the next generation: “Do what you love and love what you do. It is going to have an impact on the quality of your life. This is why I decided to be self-employed.

“That’s why even when I put in 12 or 14 hours, I don’t feel tired. I enjoy it. I’m producing for myself and my family.

“Another thing is continuing education. We all pursue continuing education. If a client comes through the doors with a question, I want to be able to answer him. If you are a consultant, you must always keep learning. If you can’t share knowledge and point them in the right direction, what good are you?”

Most important is your character. “I always tell them, ‘Listen, honesty is your biggest capital.’”